* Hong Kong manufacturers have been consciously upgrading their products. However, their gross profit margin has been cut to hair's breath in the past years. This is because they have been absorbing the rising pressure in export prices due to escalating production costs.

* Labour costs that comprise wages, social security contributions and other welfare benefits have increased by some 25% in the past two years. While the average wages of staff and workers in the PRD rose by a norm of 20%, social security contributions that roughly equal to 18% of the wage income represent an extra 4% increase in staff expenses.

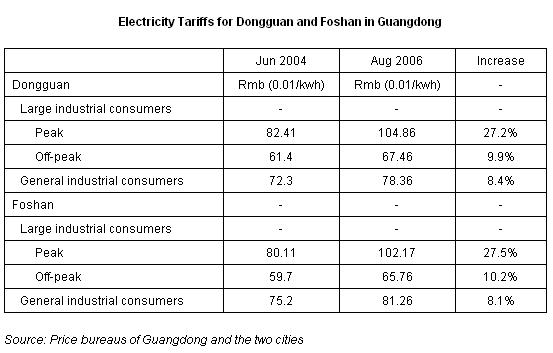

* Utilities costs have also gone up in the past two years. In Dongguan, for instance, the off-peak and peak-hour electricity tariffs for large industrial users soared by 10% and 27% respectively. Sewage treatment charges more than tripled from RMB 0.25 per tonne to RMB 0.8 per tonne.

* The RMB exchange rate has been appreciating since June 2005. It is estimated that the local content of Hong Kong companies producing on the mainland typically ranges from 20-45%. A 10% appreciation of the RMB would translate into a 2-4.5% rise in production costs.

* If labour costs account for 15-30% of the total production cost, just the rise in wages and RMB appreciation in the past two years alone have already resulted in an estimated increase of 6-12% in the total production cost.

* China's latest move to reduce the export VAT rebate is another blow. Assume a 30% local content as the value-added portion carried out within the mainland, a reduction in VAT rebate by two percentage points would mean the profit margin to be eaten up roughly by one percentage.

* Soaring raw material prices in the international market have also hit Hong Kong manufacturers. While the general metal price level has almost doubled in the past two years, the price of key metals such as copper and zinc surged by 130% and 190% respectively.

* Hong Kong manufacturers have already reached the limit in accommodating rising production costs. There seems a growing trend that some burden of cost escalation in producing on the mainland has to be borne by overseas buyers.

1. Introduction

Given China's recent escalating inflation, there are comments warning that the disinflationary impact from China may begin to vanish. While China's higher consumer price inflation can mainly be attributed to the surge in food prices and should have less direct impact on export prices of industrial goods, one should not overlook the fact of rising production costs in China, in particular in the Pearl River Delta region (PRD) in Guangdong where most Hong Kong manufacturers are clustered.

China as a world production base for light manufacturing goods has benefited world consumers with quality products at reasonable prices. While Hong Kong manufacturers have continued to upgrade their output over the years, they have also tried to accommodate the upward pressure on export prices. However, most recent policy changes on processing trade in China have exerted additional cost pressures on them amid the deteriorating operating environment in the PRD.

2. Rising Production Costs in the PRD - a challenge to all industries

2.1 Rising labour costs

The PRD has suffered from labour shortage in recent years and wage increases is a problem facing all manufacturers. In 2006, a shortage of 2.5 million workers was recorded by the Guangdong's Labour and Social Security Office as total demand in the labour market in the province reached 7.3 million, but supply amounted to 4.8 million only. The shortage has expanded further in 2007 as the demand for ordinary workers and technicians in Guangdong has estimated to increase by 9.5% and 20.4% respectively.

Insufficient supply of migrant workers in the PRD, i.e. workers from provinces outside Guangdong mainly engaging in lower-end work, has pushed up the wage levels of these workers. According to a survey by Guangdong's Labour and Social Security Office, at the start of 2007, wages of newly recruited migrant workers increased by 8% again after substabtial growth was already recorded in previous years.

Minimum wage

Tracking the official minimum wage levels can offer a systematic way to grasp the rising trend of labour costs. The minimum wages of different cities in Guangdong have risen in the range of 12.1-21.5% in the past two years.

The minimum wages of Guangzhou, Foshan, Dongguan and Shenzhen, the four cities where most Hong Kong manufacturers are located, have grown by an average of 18% over the last couple of years. It is reported that Guangdong is considering raising the minimum wage again next year in view of rising living costs.

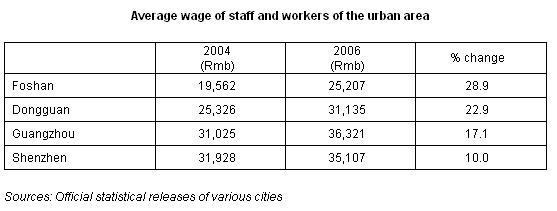

Average wages

In most cases, manufacturers need to offer above the minimum wage in order to attract new workers or retain existing ones. Furthermore, a company needs to employ different levels of staff at different jobs. According to the official releases of the average monthly wages of staff and workers (consisting of all types of jobs at different levels), the four cities in the PRD where most Hong Kong manufacturers are located has increased by an average of 20% over the last two years.

Social security schemes

Closely related to wage levels, increasing social security contributions are another added burden to manufacturers in the PRD. In an effort to build up a stable society, Guangdong is stepping up efforts to fully implement a social security system. In the past, not all workers were required to join every social security scheme. However, in recent years, Guangdong has pushed forward more aggressively in expanding the coverage of these schemes among workers.

Currently, there are five types of social insurance premiums: namely basic old-age insurance, basic medical insurance, unemployment insurance, work-related injury insurance and child-bearing insurance. While the coverage of the last one is still limited, the coverage of the other four insurance schemes is expanding. Meanwhile, the amount of contributions to various schemes by the employer for each worker has also increased in line with the wage rise.

The following is an illustration on the insurance premiums paid by an employer for each worker in Dongguan. Assuming a worker in Dongguan earning the average wage of staff and workers of the city, taking the four major insurance schemes together, the total contribution by the employer roughly equals to 18% of the wage income of the worker.

One should also note that, the contribution rate of the basic old-age insurance varies among different cities. The 10% rate charged in Dongguan is relatively low compared with other cities, which can be as high as 20%.

Besides the four major insurance schemes, local governments are also pushing ahead to expand the coverage of other statutory welfare items. For example, Dongguan is planning to fully implement the housing funds under which enterprises are required to contribute not less than 5% of the worker's wages.

Rise in production costs due to wage hikes and welfare contributions

Wages constitute different percentage shares of the cost structure among different industries. Take the case of garment manufacturing where wage expenditure accounts for 20-30% of the total production cost, other things remain unchanged, an average 20% increase in wages in the past two years has already represented a 4-6% rise in the total production cost.

If wage expenditure accounts for about 30% of the production cost, social security contributions that roughly equal 18% of the wage income is estimated to account for about another 5% of the production cost. A rough estimation shows that a 20% increase in the wage level would result in another 1% rise in production cost due to the social security contributions.

For sectors requiring more skilled labour input, such as higher-end watches where wage expenditure can reach as high as 30-40% of the total production cost, the pressure from rising wages and expanding coverage of social security contributions may even be higher.

2.2. Rising utilities charges

Electricity

Although electricity charges account for a relatively small share of total cost (some garment and toy manufacturers indicate that utilities account for about 2-3% of the production cost), electricity tariffs are rising. In Dongguan, for instance, starting from August 2006, the peak-hour electricity tariff for large industrial consumers has soared by 27% compared with 2004. Even off-peak tariffs have increased by 10%.

As there have been signs of deterioration in Guangdong's power supply situation, many Hong Kong manufacturers have invested in their own power generators, so as to ensure smooth production in times of blackouts. In certain locations, electricity supply may be suspended once a week or every four days. However, high oil prices are pushing up the cost of self-generated electricity. Some manufacturers estimated that the cost of using their own power generators could be as much as 50% more than local electricity tariffs.

Sewage Treatment

Due to rising emphasis on environmental protection, Guangdong will be gradually raising its sewage treatment charges in the next few years in accordance with the principle of "recovering cost at a small profit". In Dongguan, for instance, sewage treatment charges were raised from RMB 0.25 per tonne to RMB 0.6 per tonne in 2004 and to RMB 0.8 per tonne in 2006, a cumulative increase of more than 300%. While this upward trend of charges is expected to continue, manufacturers will also have to increase their investment in green manufacturing to reduce the amount of pollutant discharge.

3. Appreciating RMB adds onto the burden of rising local costs

By July 2007, the RMB exchange rate had crept up 9.3% against the US dollar and 22% against the yen since June 2005 (before the exchange rate reform). The trade weighted average exchange rate was also up by 6.9%.

While most Hong Kong manufacturers still receive USD payments for their exports, the appreciation of the RMB means that the part of production costs settled in RMB would increase in terms of the USD and that will eat into their export margins. According to a survey by the Hong Kong Trade Development Council (HKTDC), it is estimated that the local content (that is the part of production cost settled in RMB) of Hong Kong companies producing on the mainland ranges from 20-45%, with an average of 30%. A 10% appreciation of the RMB against the USD would translate into a rise of production costs by 2-4.5% on top of other increases.

Preliminary findings of a survey commissioned by HKTDC and conducted by the Institute of International Economics of the National Development and Reform Commission show that among various types of enterprises in the PRD, 62.7% of the responding enterprises indicate that they could tolerate an appreciation of the RMB of up to 10%. So, it can be said that the magnitude of the appreciation of the RMB recently is approaching the limit of their tolerance. In view of the likelihood that the RMB will continue to appreciate, the pressure on production costs is deemed to rise.

4. Surge in raw material prices put additional pressure on different industries

Prices of raw materials in the world market have risen rapidly in recent years. According to The Economist commodity-price index, the general metal price level has almost doubled in the last two years. The average price of major metals such as alluminimum alloy increased by 45% in July 2007 compared with two years ago, and the prices of copper and zinc even surged by 130% and 190% respectively for the same period of comparison.

The rise in metal prices inevitably has a direct impact on metal products. For example, while labour costs account for only about 10-15% of the production cost of a manufacturer of aluminium alloy products, the share of raw materials can be as high as 60-70%. A 45% increase in the price of aluminium alloy in the past two years could have meant a 25-30% increase in the production cost.

Every manufacturing process actually involves many different kinds of raw materials. Therefore, metal price increases are, in fact, having a widespread impact across different industries albeit differing in terms of magnitude. For example, a typical hard toy manufacturer may need to purchase electronic components, resins, fabric, metals, packaging and chemicals as inputs. Besides a direct impact on the cost of metal input, metal price increases may also have an indirect impact on the cost of electronic components.

Other industries, such as manufacturing of metal watches, may have a larger share of metal as input. Price increases in copper, steel and titanium, etc., would have a greater impact on their production cost.

Although price rises in the materials for garments, such as cotton, are not as significant as metal, metal accessories for manufacturing garments are also being affected. The price of plastics has not risen as significantly as metal prices, but has shown a certain volatility. Fluctuations in raw material prices will cause uncertainties to manufacturers particularly in between providing quotations and formal contracts, which may undermine the profit margin.

5. Tightening processing trade policies - the last straw

The rising cost factors mentioned above are already taxing to manufacturers in the PRD. According to a recent survey by HKTDC among Hong Kong manufacturers, the median gross profit margin of processing trade has dropped markedly from 18% five years ago to 10% at present.

Like the last straw on the camel's back, China's latest moves to reduce the export VAT rebate and processing trade's import tax preferential treatment will add extra cost pressures to PRD manufacturers.

The three major recent tightening measures introduced by the Chinese government on processing trade can be summarised as below:

(1) Adjustment of export VAT rebate

* Two rounds of removal and reduction of VAT rebates took place recently. One in September 2006 that affected over 1,250 products, another one in July 2007 that affected 2,820 products.

* The latest reduction in July 2007 affected many Hong Kong companies' products including bags and luggage, clothing, footwear and headgear, umbrellas, furniture, watches and clocks and toys.

* The removal or reduction of export VAT rebate has a direct impact on the cost of export enterprises.

(2) Expansion of "prohibited" category of processing trade

* After two rounds of expansion, as of April 2007, 1,140 products are put under the "prohibited" category of processing trade.

* Production of such items can no longer enjoy the preferential treatment of bonded import of materials and parts. Imports will be subject to import tariffs and VAT.

(3) Expansion of "restricted" category of processing trade

* The "restricted" category of processing trade was expanded from 394 items to 2,247 in July 2007. Newly added items that will affect Hong Kong companies' exports include plastic products, textiles, furniture and ceramic products.

* Companies engaging in the processing trade of the restricted category are required to pay a deposit either equivalent to 50% or 100% of the amount of tariffs and VAT payable. This poses a heavy burden on the cash flow of processing trade companies.

5.1 Reduction of export VAT rebate

The removal or reduction of export VAT rebates has a direct impact on the cost of export enterprises. For enterprises processing with imported materials, the locally produced materials and parts used by them as well as the value-added portion carried out within the mainland are subject to VAT "exemption, deduction and rebate". In other words, tax payable = output VAT on goods for domestic sale - (input VAT - amount of tax on export goods not eligible for exemption, deduction or rebate), where the amount of tax on export goods not eligible for exemption, deduction or rebate = FOB price of exports x (VAT rate - export rebate rate).

A hypothetical case on the impact of VAT reduction:

VAT Exemption, Deduction and Rebate for a Garment Manufacturer

Take a simple case where only imported materials are used.

Assume no input tax on local purchase, i.e. all imported materials

Value of bonded imports: RMB 7 million

Assume a 30% local content as the value-added portion carried out within the mainland

FOB price: equivalent to RMB 10 million

VAT rate: 17%

Export VAT rebate rate: 13% before adjustment and 11% after adjustment

Amount of VAT payable = sales VAT on domestic sales - (input tax - amount of export VAT not eligible for exemption, deduction and rebate)

Amount of VAT not eligible for exemption, deduction and rebate:

Before adjustment = (RMB 10 million - RMB 7 million) x (17% - 13%)

= RMB 120,000

After adjustment = (RMB 10 million - RMB 7 million) x (17% - 11%)

= RMB 180,000

VAT for enterprise (absolute amount of VAT payable):

Before adjustment = 0 - (0 - RMB 120,000) = RMB 120,000

After adjustment = 0 - (0 - RMB 180,000) = RMB 180,000

There is an increase in the amount of VAT payable at RMB 60,000, which equals to about 0.6% of the export value meaning the profit margin will be eaten up roughly by one percentage point.

5.2 Full payment of tariffs and VAT for imported raw materials and parts

For processing enterprises having to import materials and parts that have been put under the "prohibited" category in the latest policy change, the impact is much greater and the increase in their costs is much higher. Before the policy change, such processing enterprises could import the necessary raw materials under bond in the form of a processing trade contract. But with the implementation of the new policy, now raw materials put under the prohibited category in processing trade can only be imported in the form of general trade and as such they are subject to customs duty and VAT. And since the export VAT rebate rate of these products are zero, their production costs go up significantly. Currently many of those put under the "prohibited" category are raw material types of products, such as paper and paperboard, leather of animals and metal raw materials. The higher costs that these sectors are bearing may eventually translate into higher input costs for the downstream sectors.

5.3 Deposit of tariffs and VAT payables for imports

Enterprises engaging in the processing trade of products under the "restricted" category are subject to the customs duty deposit system. They are required to open a customs duty deposit account at a designated bank and pay into this account an actual deposit when they file their processing trade contracts with the commerce departments. Categories A and B enterprises have to pay a deposit equivalent to 50% of the import-related taxes (tariffs and VAT) while Category C enterprises are required to pay a deposit equivalent to 100%. At present, the majority of Hong Kong-invested processing enterprises are Category B enterprises. The customs duty deposit requirement would hold up their funds and induce finance costs.

Though the latest expansion of the "restricted" category affects mainly manufacturers exporting plastic products, textile products and furniture, it is widely expected the scope of the "restricted" category will be further expanded as in the case of the "prohibited" category. If, unfortunately, a Hong Kong manufacturer is affected, the cost impact is immediate.

In the case of the toy industry, raw materials in general account for 60-70% of production costs and the proportion is even higher for electronic toys. Take an enterprise with a business turnover of USD 500 million for example. With the cost of raw materials amounting to 60% of this figure, applying the 22% integrated tax rate, payable in customs duty deposit (i.e. the funds held up) would reach USD 33 million.

6. Conclusion - limit in accommodating the rising cost

Assume labour accounts for 15-30% of production costs and the local content ranges from 20-45% for Hong Kong's manufacturers in the PRD, based on the above rough estimation, just the rise in wages and RMB appreciation in the past two years have already resulted in an estimated rise of 6-12% in production costs in general, not taking into account of rises of other input costs. While the cost pressure generating from labour and the RMB will continue, extra cost burden derived from the policy changes and others can be a matter of life or death.

As evident in the shrinking profit margin of Hong Kong manufacturers in the past five years, they have been trying very hard to accommodate the upward pressure on export prices. However, there seems a rising trend that overseas buyers are pressed to seriously consider sharing more of the burden of cost increases before quality suppliers are being forced out of business.